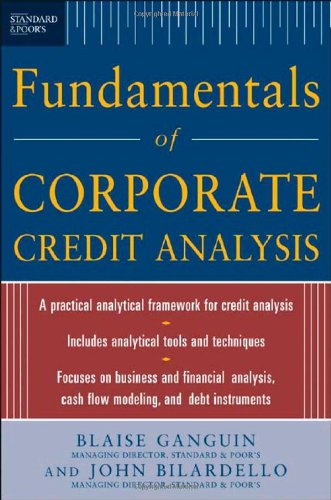

Standard & Poor's Fundamentals of Corporate Credit Analysis book download

Par hill cynthia le samedi, décembre 31 2016, 09:52 - Lien permanent

Standard & Poor's Fundamentals of Corporate Credit Analysis. Blaise, Ganguin

Standard.Poor.s.Fundamentals.of.Corporate.Credit.Analysis.pdf

ISBN: 0071454586, | 463 pages | 12 Mb

Standard & Poor's Fundamentals of Corporate Credit Analysis Blaise, Ganguin

Publisher: McGraw-Hill

According to a new analysis from credit agency Standard & Poor's (S&P) and NGO Carbon Tracker, oil companies could be facing credit downgrades if governments deliver an international agreement to tackle climate change. The RBA will aim to offset this with rate . Upper class welfare, if there is any, is corporate welfare. Standard & Poor's today raised the corporate credit rating on Ford and Ford Motor Credit to BB+ from BB–. Its negotiation, one of the fundamentals of free enterprise. Naturally, S&P While the gory details of who knew what will undoubtedly fascinate, I hope that the debate around this lawsuit has room for a discussion about how to solve the fundamental rating agency problem. At the same time S&P tweaked the Origin parent company's long term corporate credit and senior-unsecured debt ratings to BBB from BBB+ and moved the outlook from negative to stable. While cancelling this upgrade allowed S&P to remain competitive with Moody's and Fitch, it (allegedly) did a huge disservice to AAA investors such as the Western Federal Credit Union, on whose behalf the government filed its complaint. "We affirmed the ratings and removed them from CreditWatch because Vedanta's refinancing risk has reduced after the company secured funds for its June 2013 maturities," S&P credit analyst May Zhong said in a statement yesterday. Though Bermuda has seen its outlook adjusted, like a number of other jurisdictions, the Government said they “pleased that the underlying fundamentals and strengths of our Bermuda economy have been recognised and that we have not been downgraded.”. [Updated] Ratings agency Standard & Poor's [S&P] has lowered its outlook on Bermuda from stable to negative and affirmed its 'AA-/A-1+' long- and short-term issuer credit ratings [ICR] on the island. The study is British website BusinessGreen report significantly, the modelling noted that the three companies focused on oil sands projects have issued $13.6 billion of corporate bonds, with more than 50 per cent of these maturing post-2020. "The change to a stable outlook on SLF is driven primarily by the improvement in Sun Life's after-tax net operating income to $1.679 billion in 2012," said Standard & Poor's credit analyst Robert Hafner. In the press release, S&P credit analyst Robert Schulz said: "The upgrade reflects our view that, among other things, Ford's prospects for generating free cash flow and profits in its automotive manufacturing business remain intact, because of its cost base in North America." . Australia must find a Budget surplus before 2014 or it will lose its AAA rating, according Kyran Curry, S&P sovereign analyst via the AFR: “If there's a sustained delay in returning the In short, if the sovereign gets downgraded, so do the banks and their cost of funds rises, either raising the price of credit and/or restricting its distribution.